Category Archives: Web Hosting Articles

What causes a person to become radicalized?

This was the subject of a fascinating talk delivered by Tamar Mitts, an assistant professor of international and public affairs at Columbia University, at a “data science day” hosted by the school on Wednesday. Mitts studied the efficacy of Twitter-disseminated propaganda supporting the self-identified Islamic State, or ISIS, in 2015 and 2016. To avoid the “obvious ethical issues” which attend to subjecting humans analysts to ISIS propaganda, Mitts said she used machine learning algorithms to identify and sort messages and videos into various categories, such as whether they contained violence. Then she parsed her dataset to uncover trends.

Mitts’ results were a revelation. Even though people tend to associate ISIS propaganda with heinous acts of brutality—beheadings, murder, and the like—Mitts found that such violence was, more often than not, counterproductive to the group’s aims. “The most interesting and unexpected result was that when these messages were being coupled with extreme, violent imagery, these videos became ineffective,” Mitts said. In other words, the savagery for which ISIS became famous did not appeal to the majority of its followers; positive messaging found greater success.

There’s a caveat though: Anyone who was already extremely supportive of ISIS became even more fanatical after encountering a piece of propaganda featuring violence. So, while violent acts turned off newcomers and casual sympathizers, they nudged ideologues further down the path of radicalization. Extremism begets polarity.

In the wake of the Christchurch massacre, Mitts’ research gains even more relevance. Tech giants are continuing to fail to curb a scourge of violence and hate speech proliferating on their sites. World governments are, meanwhile, passing ham-fisted policies to stem the spread of such bile.

Perhaps Mitts’ discoveries could help society to avoid repeating history’s darkest moments. My appreciation for her work grew after I finished reading In the Garden of Beasts, a gripping journalistic endeavor by Erik Larson, which details the rise of Nazi Germany through the eyes of an American ambassador and his family living in Berlin. Afterward, I watched a YouTube video—an innocuous one—recommended by the author: Symphony of a Great City, a 1927 film that documented the daily life of ordinary Berliners at that time. It amazes me to think how, within a few years, these souls would come under the sway of Hitler’s bloodthirsty regime.

While the Internet makes zealotry easier than ever to incite, today’s tools also make it easier to study.

Robert Hackett

@rhhackett

Welcome to the Cyber Saturday edition of Data Sheet, Fortune’s daily tech newsletter. Fortune reporter Robert Hackett here. You may reach Robert Hackett via Twitter, Cryptocat, Jabber (see OTR fingerprint on my about.me), PGP encrypted email (see public key on my Keybase.io), Wickr, Signal, or however you (securely) prefer. Feedback welcome.

Time passes quickly and the WiFi is spotty here in Trāyastriṃśa, so I apologize for taking so long to check out how you’ve been doing with our company.

Of course, truth be known, Apple was already on that trajectory when I handed you the company, but props anyway.

Beyond that, though, I feel I must ask: Is that ALL you could manage with that money and talent? Seriously?

OK… Let me calm down… Deep breath… Nam Myoho Renge Kyo… Nam Myoho Renge Kyo.. That’s better.

Look, Tim, I don’t want to go all heavy on your case, but here’s what you need to do to make Apple great again:

1. Invest in new technology.

You let our cash on hand get all the way up to $245 billion??? Earning maybe 3% interest? Are you out of your mind?!?! With those deep pockets, we should be making huge investments and acquisitions in every technology that will comprise the world of the future. You’ve let that upstart Musk make us look like IBM. That’s just plain wrong.

2. Attack and cripple Google.

Google is our new nemesis, remember? They attacked our core business model with that Android PoC. But, Tim, c’mon… Google is weak. They can’t innovate worth beans and most of their revenue still comes from online ads, which are only valuable because they constantly violate user privacy. You could cut their revenues in half if you added a defaul 100% secure Internet search app to iOS and Mac OS. Spend a few billion and make it faster and better than Google’s ad-laden wide-open nightmare. This isn’t brain surgery.

3. Make the iPad into a PC killer.

WTF? The iPad was supposed to be our big revenge on Microsoft for almost putting us out of business. All it needed was a mouse and could have killed–killed!–laptop sales. Sure, it would have cut into MacBook sales, but that’s the way our industry works. I let the Macintosh kill the Lisa, remember? And the Lisa was my personal pet project. The iPad could have been the next PC… and it still might not be too late.

4. Give our engineers private offices.

I get it, Tim. You’re not a programmer. You built your career in high tech but it was always in sales and marketing, which are the parts of the business where a lot of talking and socializing make sense. But if you’d ever designed a product, or actually written code, you’d know engineering requires concentration without distractions. Programmers and designers don’t belong in an open plan office. Give them back their private offices before it’s too late.

5. Don’t announce trivial dreck.

A credit card? Seriously? Airbuds with ear-clips? A me-too news service? Is that best you can do? And what was with Oprah And Spielberg at the event? Hey, the year 2007 called and wants its celebrities back. Look, when you gin up the press and the public up for a huge announcement and it’s just meh tweaks to existing products or me-too stuff, it makes us look lame and out of touch. If we don’t have anything world-shaking, don’t have an announcement!

6. Stop pretending we’re cutting edge.

There was a time–I remember it well–when people would line up for hours just to be the first to get our innovative new products. Heck, we even had “evangelists” who promoted our products to our true-believers. But that’s history. Until we come out insanely great new products that inspire that kind of loyalty, dial down the fake enthusiasm.

7. Make Macs faster, better, cheaper–more quickly.

I’m honestly embarrassed what you’ve done with the Mac. You’ve not released a new design in years. Sure, MacBooks were cool back in the day, but now they’re just average. And where’s our answer to the Surface? Tim, you actually let Microsoft–Microsoft again!–pace us with a mobile product. That’s freakin’ pitiful.

8. Diversify our supply chain out of Asia.

Tim, Tim, Tim… I love Asia, but you’ve bet our entire company on the belief that there will never be another war (shooting or trade) there. Meanwhile, China has become more aggressive and there’s a madman with nuclear weapons perched a few miles from our main supplier for iPhone parts. Wake up! We need to sourcing our parts in geographical areas where war is less likely.

9. Fix our software, already.

This was the one that surprised me the most. I knew that iTunes, iBooks, Music, and AppStore was a crazyquilt but I figured we could fix that in a future release. But here we are, ten years later, and we’re still asking people to suffer through this counter-intuitive bullsh*t? And what’s with the recent instability with our operating systems? And that wack Facetime security hole?

10. Make some key management changes.

Delete your account.

Beatifically,

Cranfield University has replaced its Veeam and Data Domain backup infrastructure for one comprising Rubrik backup appliances and Microsoft Azure cloud storage.

In doing so, it has cut its on-site hardware footprint from 24U to 4U, slashed equipment and licensing costs, and reduced data restore times from hours or days to minutes.

The move also gives Cranfield peace of mind in disaster recovery by gaining the ability to run all operations from any location using virtual servers running in Azure, should the entire site become unavailable.

The refresh comes alongside one in which the university replaced its existing Pure Storage flash storage arrays with 12 nodes of Nutanix hyper-converged infrastructure hardware.

The entire project is a drive towards simplifying Cranfield’s on-site physical infrastructure in a move that encompasses cloud as a site for storage (and compute in case of outages).

Cranfield is a leading research establishment in science, industry and technology, with 1,600 staff and 4,000 postgraduate students.

Its IT stack is based around Microsoft and Linux servers with Microsoft and Oracle-based applications. It is effectively 100% virtualised on VMware, with 400-600 virtual machines running at any one time.

Its existing backup infrastructure was based on Veeam backup software and Data Domain hardware, with replication to a third party-hosted Data Domain box.

That setup had reached end of life and was showing the signs, said head of IT infrastructure Edward Poll.

“Data Domain did what it was supposed to do, but it was time to refresh things and we wanted to reduce costs, management time and complexity, and increase performance,” he said.

“The major issue with Data Domain had become restores. It ingests well, but recovering was more problematic. It would be fine for one restore, but if we’d had to restore multiple – 50, 100 or 150 – servers, we would have struggled.”

Cranfield’s IT department had already started a journey towards cloud by using StorSimple appliances – with about 80TB on site and 0.5PB in the Azure cloud – and had discovered how cost-effective it can be.

“Azure was a good fit and we started by thinking we could use Veeam and Data Domain instances in the cloud, but it was suggested to us, ‘why not get rid of a layer of software?’, and we looked at using Rubrik appliances,” said Poll.

Rubrik is part of an emerging category of backup appliances that come as nodes that build into clusters in a similar way to hyper-converged infrastructure.

Rubrik’s software appliance can come on approved server hardware from Cisco, HPE or Dell with flash and spinning disk inside. Capacities for a minimum four-node cluster are in the 64TB-160TB range, depending on the hardware.

Customers can set policies to specify how long data should be retained as a backup and which can be accessed for production use from Rubrik hardware. Rubrik backup data is seen as an NFS file share before being sent to an in-house physical archive or the cloud.

Cranfield has deployed eight Rubrik R348S nodes with a total of about 80TB of storage on site, with flash and SAS spinning disk tiers of storage inside. Data is ingested, then copied off to the Azure cloud.

The key benefits for Poll’s team are the substantially better restore times, plus the ability to potentially restore virtual machines in the cloud, allowing staff to work from any location in the event of a disaster.

Rubrik’s CloudOn enables rapid recovery to allow for business continuity in the event of a disaster, said Poll. “If our on-prem site is down, we can quickly convert our archived VMs into cloud instances, and launch those apps on-demand in Azure,” he added.

“We don’t notice any difference in data ingest, but performance on restores is very much better.”

In cost terms, Cranfield had been spending £50,000 a year on off-site hosting. It now spends about £25,000 a year with Microsoft Azure.

Meanwhile, time spent managing backup is down from about half a day a week to five minutes a day.

In terms of physical space and equipment savings, Poll said the university had turned off 42U of storage and backup devices, of which backup servers and Data Domain comprised 24U.

“Overall, it has given us a simpler, faster and more reliable backup service,” he said. “It is more easily integrated with a department that is moving towards a DevOps model, and when it comes to data recovery, we are down to minutes rather than many hours.”

The storage and backup refresh – with the move towards hyper-converged infrastructure – forms part of a wider plan to rationalise IT by making use of contemporary devices’ formats with a smaller physical footprint, as well as the cloud.

Poll added: “The university masterplan is to knock down the IT department and to no longer have two large datacentres on site. Instead, there will be one datacentre, a ‘resiliency room’ for redundancy of network equipment, and the cloud.”

While millions of Americans were enjoying a warm spring weekend, Facebook employees were hard at work responding to an avalanche of news about their company. After an already busy week for the social media platform—including a lawsuit from the Department of Housing and Urban Development, as well as a policy change regarding white nationalist and separationist content—five major Facebook stories broke over the last few days, including a Washington Post op-ed in which CEO Mark Zuckerberg calls for the social network to be regulated. Here’s what you need to know to get caught up.

Facebook Explores Restricting Who Can Livestream

The torrent of Facebook news began Friday, when COO Sheryl Sandberg said the company was “exploring restrictions on who can go Live depending on factors such as prior Community Standard violations.” The decision came less than three weeks after a terrorist attack in Christchurch, New Zealand, that killed 50 people was livestreamed on Facebook. The social network, as well as other companies like YouTube, struggled to stop the shooter’s video from being reuploaded and redistributed on their platforms.

In 2016, Zuckerberg said that live video would “create new opportunities for people to come together.” Around the same time, the company invested millions of dollars to encourage publishers like Buzzfeed to experiment with Facebook Live. The feature provided an unedited, real-time window into events like police shootings, but it was also repeatedly used to broadcast disturbing events. After the Christchurch attack, Facebook is now reexamining who should have the ability to share live video, which has proven difficult for the company to moderate effectively.

Sandberg also said Facebook will research building better technology to “quickly identify edited versions of violent videos and images and prevent people from re-sharing these versions.” She added that Facebook had identified over 900 different variations of the Christchurch shooter’s original livestream. Sandberg made her announcement in a blog post published not to the Facebook Newsroom but to Instagram’s Info Center, indicating Facebook wants its subsidiaries to appear more unified.

Old Zuckerberg Blog Posts Disappear

Also on Friday, Business Insider reported that years of Zuckerberg’s public writings had mysteriously disappeared, “obscuring details about core moments in Facebook’s history.” The missing trove included everything the CEO wrote in 2007 and 2008, as well as more recent announcements, like the blog post Zuckerberg penned in 2012 when Facebook acquired Instagram.

Facebook said that the posts were mistakenly deleted as the result of technical errors. “The work required to restore them would have been extensive and not guaranteed, so we didn’t do it,” a spokesperson for the company told Business Insider. They added that they didn’t know exactly how many posts were lost in total.

This isn’t the first time Zuckerberg’s content has gone missing from Facebook. Last April, TechCrunch reported that some of the CEO’s messages were erased from people’s private inboxes. (Facebook later extended an “unsend” feature to all Facebook Messenger users.) And in 2016, “around 10” Zuckerberg blog posts also disappeared from the social network. The deletion was similarly blamed on a technical error, but in that case the blogs were later restored.

Zuckerberg Calls for Regulation in Four Areas

In an interview with WIRED last month, Zuckerberg said, “There are some really nuanced questions … about how to regulate, which I think are extremely interesting intellectually.” On Saturday, the Facebook CEO expanded on that idea in an opinion piece published in The Washington Post. “I believe we need a more active role for governments and regulators,” Zuckerberg wrote, calling for new regulation in four particular areas: harmful content, election integrity, privacy, and data portability.

In the piece, Zuckerberg acknowledged that he believes his company has too much power when it comes to regulating speech on the internet. He also mentioned Facebook’s new independent oversight board, which will decide on cases where users have appealed the content decisions made by Facebook’s moderators. (On Monday, Facebook announced it was soliciting public feedback about the new process.)

Zuckerberg also said the rest of the world should adopt comprehensive privacy legislation similar to the European Union’s General Data Protection Regulation that went into effect last year. There’s currently no modern privacy law in the United States, though California passed a strong privacy bill last summer, which Facebook originally opposed. Now a number of lawmakers, and lobbyists, are jockeying to get a federal privacy law in place before the state-level rules take effect next year.

The op-ed arrives as Facebook faces a looming Federal Trade Commission investigation over alleged privacy violations. Lawmakers on both sides of the aisle have also recently expressed an interest in regulating or even breaking up the social media giant. Zuckerberg’s op-ed provides a sketch of the kind of regulation that his company would be comfortable adopting. Some critics have also argued that legislation like GDPR can strengthen the dominant position of companies like Facebook and Google.

Facebook Opens Up About How News Feed Works

How Facebook chooses what content to feature in the News Feed has consistently remained mostly a mystery. As Will Oremus wrote last week in Slate, “For all of Facebook’s efforts to improve its news feed over the years, the social network remains as capricious and opaque an information source as ever.”

But on Sunday evening, Facebook quietly announced that it will begin revealing more about why users see one post over another when they scroll through their feeds. The company will soon launch a “Why am I seeing this post?” button, similar to the one it launched in 2014 for advertisements. It will begin rolling out this week and will be available for all Facebook users by the middle of May, according to Buzzfeed.

“This is the first time that we’ve built information on how ranking works directly into the app,” Ramya Sethuraman, a product manager at Facebook, wrote in a blog post. The new feature might tell users, for example, that they’re seeing a post because they are friends with someone on Facebook or because they joined a specific group. But the button will also provide more granular information, such as telling users they’re seeing a specific photo because they’ve “commented on posts with photos more than other media types.”

Facebook is also making updates to its preexisting “Why am I seeing this ad?” button. It will now tell users when an advertiser has uploaded their contact information to Facebook. In addition, it will show users when advertisers work with third-party marketing firms. For example, an ad for a shoe company might reveal the name of the marketing agency it hired to sell its new sandals.

Pivot to Paying Publishers?

On Monday morning, Zuckerberg suggested he might create a new section of Facebook dedicated to “high-quality news.” Details are scarce, but it may feature content Facebook pays publishers directly to share. The remarks were made during an interview Zuckerberg did with European media executive Mathias Döpfner, which the CEO posted to his personal Facebook page. The announcement comes a year after Facebook said it would begin deprioritizing news stories in its News Feed in favor of content from friends and family.

Last week, Apple announced it was launching a $10 per month paid news aggregation service called News+ (it features content from WIRED). But unlike Apple, Facebook doesn’t appear to be getting into the subscription business. “We’re coming to this from a very different perspective than I think some of the other players in the space who view news as a way that they want to maximize their revenue. That’s not necessarily the way that we’re thinking about this,” Zuckerberg said in the interview.

Facebook’s earlier attempts to partner with media organizations have been a mixed bag. The social network also previously explored creating a dedicated feed for publishers but abandoned the project. Without knowing more, it remains to be seen what, if anything, is going be different this time.

More Great WIRED Stories

March 29, 2019

Friends and Fellow Investors:

For March 2019, the fund was up approximately 5.5% net of all fees and expenses. By way of comparison, the S&P 500 was up approximately 1.9% while the Russell 2000 was down approximately 2.1%. Year-to-date 2019 the fund is up approximately 12.8% while the S&P 500 is up approximately 13.6% and the Russell 2000 is up approximately 14.6%. Since inception on June 1, 2011, the fund is up approximately 85.4% net while the S&P 500 is up approximately 148.5% and the Russell 2000 is up approximately 102.4%. Since inception the fund has compounded at approximately 8.2% net annually vs. 12.3% for the S&P 500 and 9.4% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends.) As always, investors will receive the fund’s exact performance figures from its outside administrator within a week or two. (If you’re an investor in the fund, you should have your 2018 K-1 next week.)

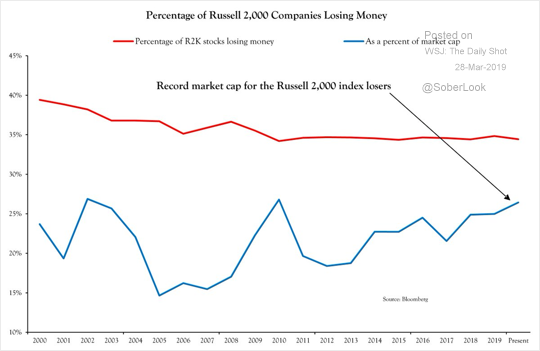

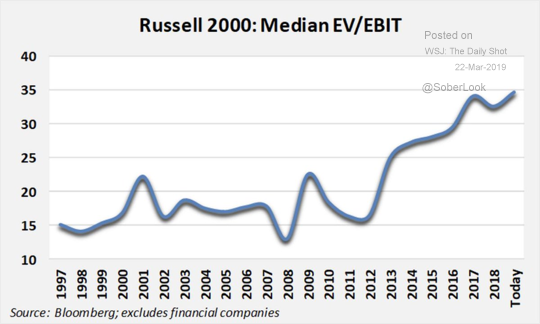

I continue to believe that what we’ve seen since the market’s late December low is a bear market rally, albeit a fierce one. The U.S. economic slowdown is in its early stages and we’re a long way from QE4; in fact, the Fed is still removing approximately $50 billion a month from its balance sheet and – despite the taper announced in March – will continue removing tens of billions of dollars a month through September, while real short-term U.S. interest rates are positive for the first time in over a decade. We thus remain short the Russell 2000 (NYSEARCA:IWM), an index which-despite incorporating almost a full year of drastically lower corporate tax rates-has a trailing twelve-month GAAP PE ratio of around 43 (and I strongly suspect the “E” will go down this year) and a record-high percentage of its constituent companies losing money…

…along with a median EV-to-EBIT that’s (almost literally!) off the charts:

Elsewhere in the fund’s short positions…

We remain short stock and call options in Tesla, Inc. (NASDAQ:TSLA), which I consider to be the biggest single stock bubble in this whole bubble market. The core points of our Tesla short position are:

- Tesla has no electric vehicle “moat” of any kind; i.e., nothing meaningfully proprietary in terms of design or technology, while existing automakers-unlike Tesla-have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

- Tesla is now a “busted growth story”; demand for its existing models has peaked and it will have to raise billions of dollars to produce new ones.

- Tesla is again losing a lot of money with a terrible balance sheet while suddenly confronting massive competition in every aspect of its business

- Elon Musk is extremely untrustworthy.

In mid-March, seemingly in response to its sliding stock price (which may have been approaching Elon Musk’s margin call territory), Tesla rushed out an ill-prepared Model Y unveiling on extremely short notice, inspiring its chief engineer to immediately quit. Supposed to be a small electric SUV/crossover, the event showed only a fake clay model and a bodywork-disguised Model 3, and was a complete embarrassment beautifully summarized here by Zero Hedge. By the time the Model Y is available in late 2020/early 2021 (if Tesla is still in business then), it will face superior competition from the much nicer Audi Q4 e-tron, BMW iX3, and Mercedes EQC.

Tesla’s backlog is now gone and new orders severely lag, and in response this month it finally introduced a $35,000 version of the Model 3. Despite the fact that this car has just 220 miles of range and comes only in black with a cheap cloth interior, I estimate it will have an EBIT loss of at least $3000 before options, which is undoubtedly why Tesla is delaying its arrival despite taking deposits for it. Tesla also introduced a 240-mile version for $37,500; that one may “only” lose around $1500 but is less likely to be “optioned up,” as it has power seats and a nicer interior (although the only standard color remains black).

Also keep in mind that since January Tesla has slashed thousands of dollars from the prices of all its other cars – longer-range Model 3s as well as the S and X, so throughout 2019 (vs. the peak quarters of Q3 & Q4 2018) Tesla will experience a deadly combination of declining volume and declining ASPs. In January, the company reported a Q4 2018 GAAP profit of $139 million that was considerably smaller than Q3’s never-to-be-topped and highly misleading (as explained in previous letters) figure of $312 million, and now as ASPs and volume decline while under-reserved warranty expenses soar, Tesla shall slide back into losses that I estimate on a GAAP basis will be well over $1 billion for 2019. That said…

In yet another example of typical Tesla “wise-guy scamminess,” the Q1 2019 GAAP loss may not be anywhere near as bad as it should be, as there’s a real chance that Tesla may use its sudden redefinition of “Full Self-Driving” (which, according to Tesla but NOT the customers who paid for that feature, now means nothing of the sort) in order to recognize hundreds of millions of dollars of deferred revenue to which it’s nowhere *near* entitled. See this excellent Twitter thread.

What else did this alleged “growth company” do in March? Well, after initially announcing (in a spur-of-the-moment cost-saving measure) that it was closing 90% of its retail stores, Tesla soon backtracked and decided to close “only” around half of them, most likely when someone informed Musk – who is truly a business moron – that the company was on the hook for all those leases anyway.

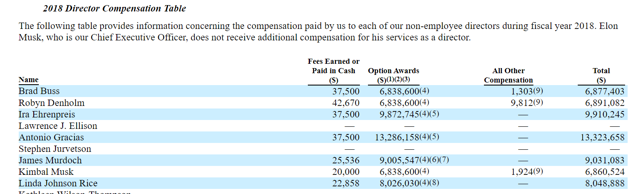

In late February, the SEC finally lost patience with Elon Musk’s continual violation of last year’s settlement stemming from his fraudulent “$420 buyout” tweet and asked the presiding judge to hold him in contempt, to which Musk (of course) swiftly responded by further mocking the SEC. Written arguments were presented by both sides in March and the presiding judge will hold a hearing on April 4th. Despite the terrible precedent Musk’s behavior sets for the CEOs of any other public company, I don’t have much faith that justice will be served here by either the court or Tesla’s fully complicit board; of course the latter’s source of complicity is clear: this is the most grotesquely overpaid group of corporate whores I’ve ever seen on the board of any public company…

…and here’s what Musk gets for his shareholders’ money from his new figurehead of an “independent” Chairwoman:

Musk’s public persona of impetuous stupidity as exemplified by his Twitter account undoubtedly provides an illuminating window into his private persona. Tesla has the most executive departures I’ve ever seen from any company (here’s the astounding full list), a dubious achievement that continued in March when in addition to the aforementioned departure of its chief engineer, still more folks departed from its already gutted finance department, as well as multiple other departments. This followed February’s departure of its general counsel after fewer than two months on the job, which followed January’s departure of its CFO, which followed the departures of a massive number of financial, manufacturing and engineering execs in 2018 and 2017. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both). Could the business (if not the stock price) be saved in its present form if he left? Nope, it’s too late. Even if Musk steps down in favor of someone who knows what he’s doing, emerging competitive factors (outlined in great detail below) and Tesla’s balance sheet make the company too late to “fix” without major financial and operational restructuring.

Also in March, Navigant Consulting came out with its annual ranking of autonomous driving capabilities, and just as last year Tesla ranked dead last among active automakers and suppliers. Meanwhile, the number of lawsuits of all types against Tesla continues to escalate – there are now over 500!

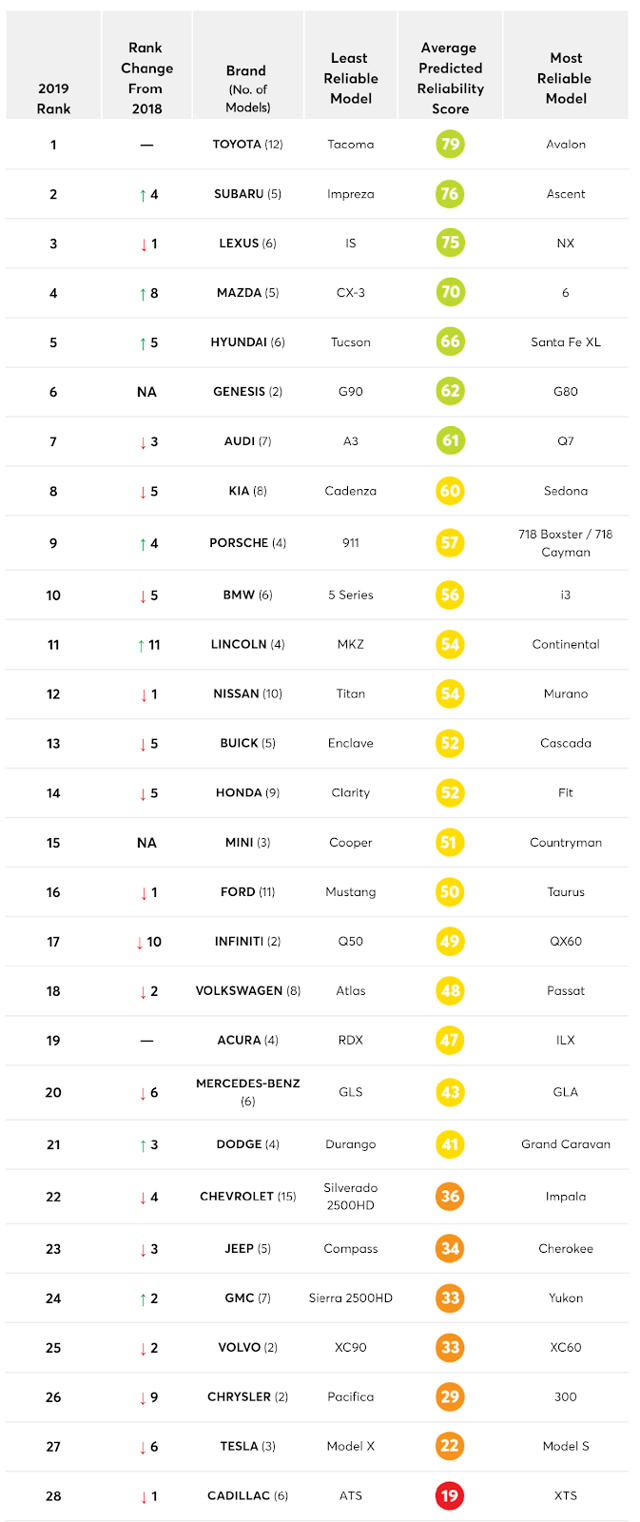

How poorly is Tesla run? The quality of its products is one indication, and in February Consumer Reports published its annual auto reliability survey and guess who finished second-to-last? As one wag said on Twitter: you can now officially call Tesla “the Cadillac of electric cars”:

Consumer Reports’ awful Tesla reliability data jibes with the latest survey from True Delta, which ranks Tesla last among all available vehicles, while in September, British magazine What Car? ranked Tesla reliability so low that it’s in “a league” of its own.

But what about all those Tesla owners who tell you how much they love their cars despite the service and reliability problems?

I’ve always argued that Tesla owners (and TSLA bulls) confuse “luxury electric car love” for “Tesla love,” and now that superior European alternatives are beginning to roll out, Tesla drivers will flock to them. For instance, among those relatively near-term alternatives (out in late 2019) is the Porsche Taycan (OTCPK:POAHY) (here’s a great new video of it), and according to Porsche’s surveys, it’s Tesla drivers who are most interested in buying it. After its U.S. tax credit price advantage over Tesla (whose credits will be gone at the end of 2019), the stunning, Autobahn and Nürburgring-tested Taycan will cost roughly the same as the least expensive Tesla Model S and, among innumerable other advantages, will charge 2 ½ times as quickly and in the U.S. include three years of that charging as part of the purchase price. Hmm, Tesla or Porsche… Not a tough choice! Porsche has the capacity to build 40,000 Taycans a year, roughly the expected number of 2019 Model S sales before the Taycan steps in to steal pretty much all of them, and in March, Porsche announced that it already has over 20,000 orders. So Model S sales are about to be *so* dead. And if that’s not enough, a crossover version of the Taycan will follow soon thereafter, as will an all-electric version of the next Maycan. So Model X sales are *also* about to be *so* dead, especially in light of the other electric crossovers and SUVs discussed below…

Porsche’s offerings are just part of an onslaught of luxury EV competition that’s about to rip the face off sales of Tesla’s most profitable models, the S&X. The Audi (OTCPK:AUDVF) e-tron and Jaguar I-Pace (see below) are already crushing S&X sales in the European countries where they’re available, and the Audi arrives here in the U.S. in April. The e-tron is an all-electric SUV with a much nicer interior (and better build quality!) than any Tesla and a price that’s around $15,000 lower than the Model X before the Audi’s (initial) $3,750 to (eventual) $7,500 U.S. tax credit advantage. (Although the Audi’s range is expected to come in at around 225 miles vs. 295 miles for the Model X, the Audi will charge faster.) The e-tron received solid reviews (here, here, here and here), and three more electric Audis will follow it: the Sportback in late-2019 and, in 2020, the spectacular e-tron GT that recently debuted at the L.A. Auto show, as well as (in late 2020) the Q4 e-tron small electric crossover.

Also currently in showrooms is the Jaguar I-Pace (which received fabulous reviews, handily beating Tesla in comparison test after comparison test) and costing $20,000 less than the Model X and $15,000 less than the Model S, price gaps that widen by an additional $3,750 with Jaguar’s current U.S. tax credit advantage and escalate to $7,500 in January 2020. I’ve driven the Jaguar and can assure you that no objective person will say it isn’t much nicer than any Tesla.

The Mercedes EQC (OTCPK:DDAIF) (OTCPK:DMLRY) all-electric SUV will be widely available in Europe in the summer of 2019 and in the U.S. in early 2020, with an EPA range of around 225 miles and a price that will be nearly $30,000 (!) less than the Model X before the Mercedes’ (by then) $7500 U.S. tax credit advantage. And by 2022 Mercedes will have ten fully electric models, covering nearly all its model lines.

And let’s not count out BMW (OTCPK:BMWYY); here’s a fascinating interview with its head EV powertrain engineer and a preview of its upcoming 2021 i4 and iX3.

Less expensive and available now are the excellent new all-electric Hyundai Kona (OTCPK:HYMLF) (OTCPK:HYMTF) and Kia Nero, extremely well reviewed small crossovers with an EPA range of 258 miles for the Hyundai and 238 miles for the Kia, at prices of under $30,000 inclusive of the $7,500 U.S. tax credit. I expect these cars to have an immediate and negative impact on sales of Tesla’s Model 3 and a future negative impact on Tesla’s Model Y (assuming, of course, the latter makes it to market before Tesla declares bankruptcy).

So here is Tesla’s competition in cars (note: these links are continually updated)…

THE NEW ALL-ELECTRIC JAGUAR I-PACE

2019 Jaguar XJ to be reborn as high-tech electric flagship

VW Group to launch 70 pure electric cars over the next decade

Audi e-tron electric SUV is available now

Audi e-tron Sportback comes late 2019

AUDI E-TRON GT FIRST DRIVE: LOOK OUT, TESLA (available 2020)

Audi’s Q4 e-tron previews entry-level EV for 2021

Porsche Electric Taycan Launches Late 2019

Porsche Taycan Cross Turismo to launch in 2020 after Taycan Sedan

The next generation of the Porsche Macan will be electric

New VW ID. hatch: order books for VW electric car open on May 2019

Mercedes EQC Electric SUV Available Mid-to-Late 2019

Mercedes to launch more than 10 all-electric models by 2022

258-Mile Hyundai Kona electric is available now for under $40,000

239-Mile Kia Niro EV is Available Now For Under $40,000

Kia Soul (available mid-2019) EV’s Range Jumps to 243 Miles

Kia Europe to have six pure electric models by 2022

Chevrolet Bolt Offers 238 Miles On A Single Charge

GM is transforming Cadillac into an electric brand

Nissan LEAF e+ with 226-mile range is available now

Nissan Leaf-based SUV coming in 2020

The 2020 Volvo Polestar 2 Is Priced to Beat Tesla’s Best-Selling Model 3

BMW iX3 electric crossover goes on sale in 2020

New BMW i4: Tesla-rivalling coupe seen winter testing

BMW to have 25 electrified models by 2025

Ford CEO says 16 electric models are in design & development

Peugeot 208 to electrify Europe’s small-car market

Toyota, Mazda, Denso create company to roll out electric cars beginning 2019

Toyota to market over 10 battery EV models in early 2020s

New Renault Zoe to feature 400km range

Renault aims to remain EV leader in Europe

Infiniti will go mostly electric by 2021

DS 3 Crossback will give PSA’s upscale brand an electric boost

ALL-ELECTRIC MINI COOPER COMING IN 2019

Smart Will Electrify Its Entire Line-up By 2020

SEAT will launch 6 electric and hybrid models and develop a new platform for electric vehicles

Opel/Vauxhall will launch electric SUV and van in 2020

2019 Skoda e-Citigo confirmed as brand’s first all-electric model

Skoda planning range of hot all-electric eRS models

New Citroen C4 Cactus to be first electrified Citroen in 2020

MG E-Motion confirms new EV sports car on the way by 2020

Fiat Chrysler bets on electrification for Alfa, Jeep and Maserati

Maserati offering three fully electric cars between 2020 and 2022

Rolls-Royce is preparing electric Phantom for 2022

Honda will offer full-EV or hybrid tech on every European model by 2025

Bentley mulls electric car to help reduce carbon footprint

Subaru to introduce all-electric vehicles by 2021

Korando will lead SsangYong’s push into electrification

Dyson Moves Ahead on $2.6 Billion Electric Car Plan

Lucid Motors closes $1 billion deal with Saudi Arabia to fund electric car production

Rivian (electric pick-up truck maker) Announces $700M Investment Round Led By Amazon

Borgward BXi7 Electric SUV Flies Under The Radar

Detroit Electric promises 3 cars in 3 years

SF Motors reveals two electric SUVs for 2019 with 300 miles of range

Two new electric cars from Mahindra in India by 2019; Global Tesla rival e-car soon

Saab asset owner NEVS plans electric car production

EV startup Canoo will only sell cars on a subscription basis

And in China…

VW, China spearhead $300 billion global drive to electrify cars

Audi Q2L e-tron debuts at Auto Shanghai

Audi China to roll out 12 locally-produced models in total by 2022

BYD launches EV535, all-electric SUV

BYD Song MAX BEV version with 500km range to hit market in 2019

2019 BYD Yuan EV360 goes on sale with prices starting RMB89,900 after subsidy

Daimler & BYD launch new DENZA electric vehicle for the Chinese market

BAIC and Daimler to Build $1.9 Billion China Plant

BAIC brings EX5 Electric SUV to market

BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

Daimler to Start EQC Electric SUV Production in China in 2019

GM China raises new-energy vehicle target to 20 models through 2023

Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

Toyota to Introduce 10 New Electrified Vehicles in China by 2020

Infiniti bringing EVs to China’s luxury car market

NIOS ES8 Electric Crossover debuts with half the Tesla Model X’s price tag

536 HP Nio ES6 Midsize Electric SUV Launches With 317-Mile Range at 1/2 the price of Tesla X

NIO’s third model said to be a sedan dubbed EP7

BMW will develop and produce electric Mini in China

Ford ramps up electric vehicle push in China

Jaguar Land Rover’s Chinese arm invests £800m in EV production

SAIC building factory in China for EVs from Roewe and MG

Renault and Brilliance Automotive to build 3 new electric light commercial vehicles for China

Honda launches new all-electric Everus VE-1 for ~$25,000 in China

Honda to roll out over 20 electric models in China by 2025

Geely all-new BEV sedan Jihe A starts at RMB150,000

Geely unveils GE11 compact BEV

New Geely Emgrand GSe crossover has EV range up to 400km

Changan building large scale NEV factory

Mazda and Changan Auto join hands on electric vehicles

XPENG Motors kicks-off sales of Tesla-infused EV for €30,000

XPENG Motors to unveil second model at Auto Shanghai 2019

WM Motors/Weltmeister EX5 Electric SUV Launched On The Chinese Car Market

Chery Breaks Ground on $240M EV Factory in China

Chery’s second EV plant open in Dezhou

BYTON to launch mass-produced M-Byte into market at the end of 2019

DearCC Launches ENOVATE Electric SUV

GAC NE to roll out 12 new models for Aion series, including solar-powered models

Guangzhou Auto To Launch Four New Electric Cars By 2020

Great Wall Launches New EV Brand (NYSE:ORA) In China

Singulato iS6 Electric SUV Debuts With 249-Mile Range

Singulato, BAIC partner to promote smart new energy vehicles

Hongqi launches E-HS3 BEV SUV with AWD option, 390km range and 0-100kh/h in 5.9 seconds

FAW (Hongqi) to roll out 15 electric models by 2025

JAC’s Electric Car Has A Range Of 500 Kilometers

ICONIQ to build electric cars in Zhaoqing with total investment of RMB 16 billion

Quianu Motor aims to grab share of US electric vehicle market

Hozon Kicks Off Mass Production With All-Electric Neta N01

Aiways U5 long-range electric SUV

All-electric NEVS 9-3 sedans (nee Saab) being built in China

Youxia Motors raises $1.25 billion to start 2019 EV production

CHJ Automotive buys Lifan for shortcut to EV production

Wanxiang Gets China Electric Vehicle Permit to Make Karma Cars

Qoros Auto’s new owner plans to be an EV power

JMC (Jianling Motor Corp.) Starts New EV Brand In China

Thunder Power Chinese EV manufacturer clinches deal with Belgian investment fund

Leapmotor raises RMB2.5 billion for Series A round to build electric cars

Continental, Didi sign deal on developing EVs for China

Here’s Tesla’s competition in autonomous driving…

Navigant Ranks Tesla Last Among Automakers & Suppliers for Automated Driving

What Smart Tesla fans Get Wrong about Full Self-Driving

Tesla has a self-driving strategy other companies abandoned years ago

Waymo Starts First Driverless Car Service

Jaguar and Waymo announce an electric, fully autonomous car

Waymo Expands Chrysler Self-Driving Fleet 100-Fold to 62,000

Nissan-Renault alliance to tie up with Waymo on self-driving cars

Uber, Waymo in talks about self-driving partnership

Lyft and Waymo Reach Deal to Collaborate on Self-Driving Cars

Cadillac Super Cruise Sets the Standard for Hands-Free Highway Driving

GM ride-hailing fleet would ditch steering wheel, pedals in 2019

Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

Ford and VW Discuss Autonomous Car Team-Up at a $4 Billion Valuation

Volkswagen Group and Aurora Innovation Announce Strategic Collaboration On Self-Driving Cars

VW taps Baidu’s Apollo platform to develop self-driving cars in China

An Overview of Audi Piloted Driving

Daimler, BMW deepen cooperation with self-driving venture

Mercedes plans advanced self-driving tech for next S class

Bosch and Daimler join forces to market fully automated, driverless taxis by 2020

Daimler’s heavy trucks start self-driving some of the way

Volvo, Nvidia expand autonomous driving collaboration

Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

Intel’s Mobileye has 2 million cars (VW, BMW & Nissan) on roads building HD maps

Toyota’s moonshot: Self-driving car for sale – in 2020

Nissan and Mobileye to generate, share, and utilize vision data for crowdsourced mapping

Magna joins the BMW Group, Intel and Mobileye platform as an Integrator for AVs

Intel collaborates with Waymo on self-driving compute design

Fiat Chrysler to Join BMW, Intel and Mobileye in Developing Autonomous Driving Platform

Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

Volvo, Baidu to co-develop EVs with Level 4 autonomy for China

BYD partners with Huawei for autonomous driving

Lyft, Aptiv (formerly Delphi) partner on driverless ride-hailing at 2018 CES in Vegas

Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

Hyundai, Aurora to release autonomous cars by 2021

Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks This Year

Byton cooperating with Aurora on autonomous vehicles

ZF autonomous EV venture to start output this year, names first customer

Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

Groupe PSA’s safe and intuitive autonomous car tested by the general public

Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

Self-driving startup Momenta ready to launch fully automated driving solution in Q3 2019

JD.com Delivers on Self-Driving Electric Trucks

NAVYA Unveils First Fully Autonomous Taxi

Fujitsu and HERE to partner on advanced mobility services and autonomous driving

Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

First Look Inside Zoox’s Autonomous Taxi

Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s Tesla’s competition in car batteries…

LG Chem targets electric car battery sales of $6.3 billion in 2020

LG Chem to build $1.8 bln EV battery plant in China

Samsung SDI Unveils Innovative Battery Products at 2018 Detroit Motor Show

SK Innovation to boost EV battery production capacity more than tenfold by 2022

New Toshiba EV Battery Allows 320km Charge in 6 Minutes

Daimler starts building electric car batteries in Tuscaloosa – one of 8 battery factories

Panasonic Opens New Automotive Lithium-Ion Battery Factory in Dalian, China

Panasonic forms battery partnership with Toyota

CATL’s Chinese battery factory will be bigger than Tesla’s Gigafactory

CATL to set up battery cell manufacturing in Germany

BYD to quadruple car battery output with lithium site plants

GM inaugurates battery assembly plant in Shanghai

Volkswagen plans entry into battery cell production

VW Wants to One-Up Tesla With a Next-Generation Battery

Honda Partners on General Motors’ Next Gen Battery Development

Energy Absolute Plots Asian Project Rivaling Musk’s Gigafactory

France’s Saft plans production of next-gen lithium ion batteries from 2020

Northvolt making ground on Gigafactory in Sweden

ABB teams up with Northvolt on Europe’s biggest battery plant

Chinese Battery Maker to Open Factory Next to Swedish EV Plant

Sokon aims to be global provider of battery, electric motor, electric control systems

BMW Group invests 200 million euros in Battery Cell Competence Centre

BMW Brilliance Automotive opens battery factory in Shenyang

BMW announces partnership with solid-state battery company

Toyota promises auto battery ‘game-changer’

VW increase stake in solid-state batteries with $100M investment

Hyundai Motor developing solid-state EV batteries

Wanxiang is playing to win, even if it takes generations

UK provides millions to help build more electric vehicle batteries

Rimac is going to mass produce batteries and electric motors for OEMs

Elon Musk Has A New Battery Rival (Romeo Power) Packed With His Ex-Employees

Evergrande acquires Cenat battery production

Bracing for EV shift, NGK Spark Plug ignites all solid-state battery quest

ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

Here’s Tesla’s competition in storage batteries…

sonnenBatterie (acquired by Shell)

And here’s Tesla’s competition in charging networks…

EVgo Installing First 350 kW Ultra Fast Public Charging Station In The US

Tritium’s First 350-kW DC Fast Chargers Coming To U.S.

Porsche plans network of 500 fast chargers for U.S.

ChargePoint To Equip Mercedes Dealerships With 150kw Charging Stations For EQC

Recargo Ultrafast West Coast Charging

BMW, Daimler, Ford, VW, Audi & Porsche form IONITY European 350kw Charging Network

E.ON to have 10,000 150KW TO 350KW EV charging points across Europe by 2020

Europe’s Allego “Ultra E” ultra-fast charging network now operational

Allego & Fortum Launch MEGA-E High Power Charging network for Europe’s Metropolitan areas

ChargePoint Secures $240 Million in Additional Funding; $500 million raised in total

UK’s Podpoint installing 150kW EV rapid chargers this year; 350kW by 2020

UK National Grid plans 350kW EV charge point network

Fastned building 150kw-350kw chargers in Europe

Deutsche Telekom to build electric car charging network in Germany

ABB powers e-mobility with launch of first 150-350 kW high power charger

Shell buys European electric vehicle charging pioneer NewMotion

BP buys UK’s largest car charging firm Chargemaster

Total planning EV charging points at its French stations

VW Is Setting Up Electric Car Charging Stations in China

Yet, despite all that deep-pocketed competition, perhaps you want to buy shares of Tesla because you believe in its management team. Really???

Elon Musk Settles SEC Fraud Charges

Elon Musk, June 2009: “Tesla will cross over into profitability next month”

Tesla SEC Correspondence Shows A Pattern Of Inaccurate, Incomplete & Misleading Disclosures

Tesla: Check Your Full Self-Driving Snake Oil Expiration Date

As Musk Hyped and Happy-Talked Investors, Tesla Kept Quiet About a Year-Long SEC Probe

The Truth Is Catching Up With Tesla

With Misleading Messages And Customer NDAs, Tesla Performs Stealth Recall

Who You Gonna Believe? Elon Musk’s Words Or Your Own Lying Eyes?

How Tesla and Elon Musk Exaggerated Safety Claims About Autopilot and Cars

When Is Enough Enough With Elon Musk?

Musk Talked Merger With SolarCity CEO Before Tesla Stock Sale

Tesla Continues To Mislead Consumers

Tesla Misses The Point With Fortune Autopilot Story

Tesla Timeline Shows Musk’s Morality Is Highly Convenient

Tesla Scares Customers With Worthless NDAs, The Daily Kanban Talks To Lawyers

Tesla: Contrary To The Official Story, Elon Musk Is Selling To Keep Cash

Tesla: O, What A Tangled Web We Weave When First We Practice To Deceive

I Put 20 Refundable Deposits On The Tesla Model 3

Tesla: A Failure To Communicate

Elon Musk Appears To Have Misled Investors On Tesla’s Most Recent Conference Call

Understanding Tesla’s Potemkin Swap Station

Tesla’s Amazing Powerwall Reservations

So in summary, Tesla is losing a massive amount of money even before it faces a huge onslaught of competition (and things will only get worse once it does), while its market cap tops that of Ford (NYSE:F) and nearly matches General Motors’ (NYSE:GM) despite selling approximately 300,000 cars a year while Ford and GM make billions of dollars selling 6 million and 8.4 million vehicles, respectively. Thus, this cash-burning Musk vanity project is worth vastly less than its roughly $60 billion enterprise value and-thanks to roughly $34 billion in debt, purchase and lease obligations – may eventually be worth “zero.”

Elsewhere among our short positions…

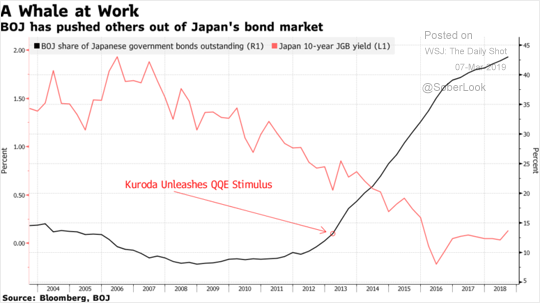

We continue (since late 2012) to hold a short position in the Japanese yen via the Proshares UltraShort Yen ETF (NYSEARCA:YCS) as Japan continues to print nearly 5% of its monetary base per year after nearly quadrupling that base since early 2013. In fact, of the world’s three largest central banks (the Fed, ECB and BOJ), the BOJ is now the only one still conducting QE, and in February, it reiterated its intent to continue doing so. One result of this insane policy (in 2018, the BOJ bought approximately 67% of JGB issuance and in 2019 anticipates buying 70%!) is there are days when no 10-year JGBs trade in the cash market! The BOJ’s balance sheet is now larger than the entire Japanese economy – it owns approximately 43% of all government debt…

…and over 75% (!) of the country’s ETFs by market value.

Just the interest on Japan’s debt consumes 8.9% of its 2019 budget despite the fact that it pays a blended rate of less than 1%. What happens when Japan gets the 2% inflation it’s looking for and those rates average, say, 3%? Interest on the debt alone would consume nearly 27% of the budget and Japan would have to default! But on the way to that 3% rate the BOJ will try to cap those rates by printing increasingly larger amounts of money to buy more of that debt, thereby sending the yen into its death spiral.

When we first entered this position, USD/JPY was around 79; it’s currently in the 110s, and long term, I think it’s headed a lot higher – ultimately back to the 250s of the 1980s or perhaps even the 300s of the ’70s before a default and reset occur.

We continue to hold a short position in the Vanguard Total International Bond ETF (NASDAQ:BNDX), comprised of dollar-hedged non-US investment grade debt (over 80% government) with a ridiculously low “SEC yield” of 0.81% at an average effective maturity of 9.4 years. As I’ve written since putting on this position in July 2016, I believe this ETF is a great way to short what may be the biggest asset bubble in history, as with Eurozone inflation now printing 1.5% annually, these are long-term bonds with significantly negative real yields. In mid-December, the ECB halted quantitative easing, thereby removing the biggest source of support for those bonds’ bubble prices. Currently, the net borrow cost for BNDX provides us with a positive rebate of over 1.7% a year (more than covering the yield we pay out), and as I see around 5% potential downside to this position (vs. our basis, plus the cost of carry) vs. at least 20% (unlevered) upside, I think it’s a terrific place to sit and wait for the inevitable denouement of this insanity:

And now for the fund’s long positions…

We continue to own Westell Technologies Inc. (NASDAQ:WSTL), a 43% gross margin telecom equipment maker (of primarily small-cell repeaters) in turnaround mode. In February, Westell reported a mediocre FY 2019 third quarter, with revenue down 22% year-over-year but up 6% sequentially, and although it burned around $970,000 in free cash flow, it ended the quarter with $27.1 million in cash ($1.75/share) and no debt, and on the follow-up conference call, management explicitly indicated that it expects to return to break-even or better within a year. Westell sells at an enterprise value of only around 0.10x (i.e. 10% of) revenue, but in addition to the (hopefully soon-to-reverse) cash burn, the “hair” on this company is the long-term decline in revenue (which now appears to have stabilized and should soon reverse), a cash pile that could potentially be squandered on dumb acquisitions (a risk with all cash-rich companies) and – perhaps most annoyingly – a dual share class, with voting control held by descendants of the founder. However, on the conference call, management claimed the controlling family is open to merging the two share classes, and Westell is so cheap on an EV-to-revenue basis that if management can’t start generating meaningful profits, it seems primed for a strategic buyer to acquire it. An acquisition price of 1x run-rate revenue (on an EV basis) would be around $4.50/share.

We continue to own Aviat Networks, Inc. (NASDAQ:AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in February reported a decent Q2 for FY 2019, with revenue up 2% year-over-year (adjusted for a GAAP-mandated change in revenue recognition to ASC 606; unadjusted revenue was up 5.5%). For FY 2019, the company guided to $250-$255 million of revenue and non-GAAP EBITDA of $12.5-$13 million, and because of its approximately $330 million of U.S. NOLs, $10 million of U.S. tax credit carryforwards, $214 million in foreign NOLs and $2 million of foreign tax credit carryforwards, Aviat’s income will be tax-free for many years; thus, GAAP EBITDA less capex essentially equals “earnings.” So if the non-GAAP number will be $12.5 million and we take out $1.7 million in stock comp and $6 million in capex, we get $4.8 million in earnings multiplied by, say, 16 = approximately $77 million; if we then add in at least $30 million of expected year-end net cash and divide by 5.4 million shares, we get an earning-based valuation of around $20/share. However, the real play here is as a buyout candidate; Aviat’s closest pure-play competitor, Ceragon (NASDAQ:CRNT) sells at an EV of approximately 0.7x revenue, which for AVNW (based on the mid-point of 2019 guidance) would be around $207 million. If we value Aviat’s massive NOLs at a modest $10 million (due to change-in-control diminution in their value), the company would be worth $217 million divided by 5.4 million shares = $40/share.

We continue to own the Invesco DB Agriculture ETF (NYSEARCA:DBA), which I first bought in late 2017 because agricultural products were the most beaten-down sector I could find that wasn’t a “buggy whip” (something on the way to obsolescence) or cyclical from a demand standpoint. The “DBIQ Diversified Agriculture Index” on which DBA is based is at its lowest level since 2002, and I continue to anticipate a major bounce following a favorable outcome from U.S.-China trade talks. Trump is very conscious of the fact that farm states constitute a significant part of his political base and the China deal implications for U.S. ag products would be huge. Meanwhile, extensive midwestern U.S. flooding (a real tragedy for those affected) put a bit of a tailwind behind this ETF in mid-March (although it subsequently surrendered some of those gains).

Thanks and regards,

Mark Spiegel

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

The coins sold by small companies in Initial Coin Offerings are often compared to penny stocks. Like penny stocks, they’re cheap. Penny stocks cost less than five bucks; a new coin released at an ICO can literally cost a penny or less. They also have the potential for huge returns. Monster Beverage, a drinks company, was selling at around 60 cents a share at the start of 2005. It’s now worth nearly $60 a share. If you had bought $100 of those shares fourteen years ago, you’d now be sitting on nearly $10,000. That’s not as high as the returns earned by early Bitcoin investors but it’s still worth having. There are some important differences between penny stocks and cheap coins from ICOs though. Here are four of them:

-

An ICO Doesn’t Give You a Company

Penny stocks might be cheap but they’re still stocks. They give you a share of a company, possibly with voting rights. An ICO only releases a product whose value you hope will rise. It’s like a new casino raising funds by selling its unique poker chips cheaply. If the casino is popular those chips could be worth a lot of money. But if the casino is never built, you’ll be left with a pile of useless discs.

-

You Can Research the People Behind the ICO

One reason that a penny stock is such a high risk is that there’s often very little information about the company or the people behind it. You might not know who the managers are, what they did before they launched the company or whether they’re serious. You might know no more than the price of the stock and the name of the business. The rest is a shot in the dark.

Before launching an ICO, cryptocurrency firms release white papers. Those white papers will explain the background of the people launching the firm. You can often contact them on Telegram and ask them questions. That doesn’t mean that you can find all the information you want, or always get the answers you need. There will always be gaps and risks. But ICOs can provide details about the people behind them.

-

You Can Research the Business Idea

The white paper should also explain what the company is doing and how it plans to do it. Again, that doesn’t mean that the company will actually do what it says. It doesn’t mean that the managers have the skill or the competence to do what they intend. But you should be able to assess their idea and decide for yourself whether or not you think it has legs. A bet on an ICO is a bet on a business idea.

-

Coins Are Easier to Buy and Sell than Penny Stocks

Penny stocks are usually bought and sold through brokers. The markets are illiquid, the commissions are high and the process isn’t straightforward. The products of ICOs aren’t always sold on major cryptocurrency exchanges but you can usually buy them directly from the companies and if the coin is a success, you can expect it to be listed in the future.

“Easier” isn’t the same as “easy” though. Trading volumes will still be small. Not all coins will be listed on an exchange and those that are listed, often find themselves on small exchanges.

Like penny stocks, buying a small coin at an ICO is a high risk venture. But you can keep your losses low, and who knows, you might just strike it big!

Published on: Mar 31, 2019

MongoDB, a database software provider whose stock has been on a tear recently, just hired its first-ever chief information security officer. The appointment, which came Friday, signals that the company plans to take security more seriously even as it faces stiffened competition from the likes of Amazon and other tech giants.

The new boss is Lena Smart, a Glaswegian cybersecurity professional. Smart formerly held the same title at IPO-bound Tradeweb, a financial services firm that supplies the technology behind certain electronic trading markets. Prior to Tradeweb, she headed security at the New York Power Authority, where she worked for more than a decade. A cellist in her spare time, Smart told me in her Scottish brogue that her priority in the new job will be “knowing what the crown jewels are—that’s our customer data—and making sure that’s always protected.”

People leaving MongoDB and other databases unsecured on the web has been a persistent source of data-leaks over the years. Just this month, a security researcher discovered one such sieve that exposed to public view a trove of sensitive information, including location data, on millions of people in China. The misconfigured repository appears to have originated from SenseNets, a Shenzhen-based company that is likely providing the Chinese government with crowd-surveilling, facial recognition technology to track the country’s muslim Uyghur population. This is just the latest leak example; there are innumerable others.

Despite the frequency of these leaks, the situation seems to be improving. Most of these inadvertent leaks have sprung, in fairness, from people using outdated instances of the company’s so-called community edition software, a free, barer-bones version of the database product. Mark Wheeler, a MongoDB spokesperson, conceded that the 12-year-old company “struggled in its early years to find the right balance with security.” But he avers that updates to the default settings of MongoDB’s software over the past few years, plus key security team hires—including guardians Davi Ottenheimer, Kenn White, and now Smart—are changing the equation.

As Smart’s scope involves securing the totality of MongoDB’s business, the data-spillage issue ultimately falls to her. She says she’ll continue educating customers in best practices when it comes to security. She says she will also aim to imbue the company’s product development process with security, quality assurance, and testing from the earliest stages. “If we can get in at the very start” of the software development lifecycle, Smart says, it will “save us time and money and make our products more reliable and secure.”

The leaky database issue is one that extends well beyond MongoDB. It’s also a problem for rivals such as Amazon, particularly its S3 buckets, Elastic, and others. Like so many companies, these database-makers are looking now to shore up their software in the hopes of turning a historical weakness—cybersecurity—into a competitive strength. As Dev Ittycheria, MongoDB’s president and CEO, tells Fortune: making the company’s products as secure as possible “is critical to our business.”

Indeed, it’s critical to MongoDB and, increasingly, every business.

A version of this article first appeared in Cyber Saturday, the weekend edition of Fortune’s tech newsletter Data Sheet. Sign up here.

This is the web version of Data Sheet, Fortune’s daily newsletter on the top tech news. To get it delivered daily to your in-box, sign up here.

MIT has been holding its entrepreneur-focused New Space Age Conference for four years, and it’s notable how quickly things have changed. For one, the first iteration fit in a smaller room and lacked the giant and delicious mid-morning doughnuts supplied for the 2019 conference. But more importantly, the focus has shifted in two ways.

Way back in 2016, Boeing was the big incumbent, the company that had dominated the space economy for decades, offering its wisdom to all the startups and would-be startups in the audience. But Naveed Hussain, who headed the company’s R&D skunkworks, sounded a bit defensive as he insisted: “We are ready to compete.” Portentously, just the day before the conference, Elon Musk’s SpaceX landed one of its reusable rockets on a barge floating at sea. In hindsight, it’s obvious that a changing of the guard had occurred.

At this year’s New Space Age conference, SpaceX was the big incumbent and its rocket technology has now moved from the demonstration stage to the workman-like commercial phase.

Shattering the cost of putting satellites in orbit has allowed dozens, perhaps even hundreds, of new startups to attract funding and go into business, kicking off a new space race. Van Espahbodi, managing partner of the Starburst Aerospace Accelerator funding many of those startups, may not have realized the irony of his statement that “ten years ago there would have been executives from Lockheed and Boeing in this room.” (It was only three, Van.)

But Espahbodi also sounded another common refrain from the 2019 edition of the conference, one that marks the second shift from 2016. While back then startups were still trying to figure out how to woo Silicon Valley, now it seems they may have succeeded too well. Espahbodi worried that too much money may have flowed into too many startups all chasing the same few satellite opportunities. “There’s lots of not so smart money out there,” he quipped.

The most impressive CEO on stage may have been John Serafini from HawkEye 360, which is launching satellites to track all manner of radio frequency signals on the ground. The company’s satellites could help stop “bad actors in a maritime environment” from creating billions of dollars of “negative externalities,” he explained. What? They’re going to catch pirates!

Aside from the excess financing chasing too few ideas, Julien Cantegreil, the CEO of SpaceAble, offered a unique reason why startups in the space market may start crashing out–literally. There’s actually a limit to how many satellites can go into orbit before debris and collisions become a big problem. “We cannot continue to send more objects to space,” he warned. “At some point we need to stop and think about the low earth (orbital) environment.” Hopefully there won’t be any actual examples of that problem to discuss at next year’s conference.

***

Lyft priced its initial public offering at $72 a share giving the company a stock market value north of $24 billion. It’s expected to be the first of many mega-startups going public this year, as my colleague Danielle Abril reports. I’m not into the false precision of many Wall Street metrics but I do like to compare startups to others in their neighborhood. Software maker Atlassian is valued at about $26 billion, Internet infrastructure operator Verisign at $22 billion, and Check Point Software at $20 billion. Lyft has the most annual revenue and the highest growth rate, though both Verisign and Check Point are already profitable. You’ll have to do your own due diligence on Lyft’s business prospects, but I’m here to say that its initial valuation isn’t crazy.

Add another perk for Amazon Prime members.

The retailer has announced a new partnership with Nintendo that will give subscribers of its loyalty program a free year of Nintendo Switch Online access. That service typically costs Switch owners $20 per year.

At the same time, Amazon is getting wise to people who use the trial window for Prime to claim the best perks. In order to take advantage of this deal, members initially will be allowed to sign up for only three months of free Switch Online access. Then, after 60 days, users can claim the remaining nine months.

There’s a Sept. 24 deadline to sign up for the first part of the perk. The nine-month extension must be claimed by Jan. 22.

The service is tied to Twitch Prime, one of Amazon Prime’s benefits. The free months can be added on to any existing paid Switch Online subscriptions.

The partnership between Amazon and Nintendo is a notable one, as the two companies have not always been on the best of terms. In 2012, for example, Amazon suddenly halted its first party sales of Nintendo hardware. (Resellers were allowed to continue selling the systems, although at prices of their own choosing.)

In 2015 the two began to patch up their differences.

Amazon, which owns Twitch, is widely expected at some point to announce a video game streaming service along the same line of Google’s Stadia. The company has not commented on speculation about such action, including any sort of timeline.

MOSCOW (Reuters) – Russia’s communications watchdog threatened on Thursday to block access to popular VPN-services which allow users to gain access to websites which have been outlawed by Moscow.

Russia has introduced tougher internet laws, requiring search engines to delete some results, messaging services to share encryption keys with security services and social networks to store users’ personal data on servers within the country.

But VPN (virtual private network) services can allow users to establish secure internet connections and reach websites which have been banned or blocked.

Russia’s communications regulator Roskomnadzor said it had asked the owners of 10 VPN services to join a state IT system that contains a registry of banned websites.

If the VPN services link to the system, their users would not be able to reach websites which had been blocked or be able to use the banned Telegram messenger service.

The internet censor said that it had sent notifications to NordVPN, Hide My Ass!, Hola VPN, Openvpn, VyprVPN, ExpressVPN, TorGuard, IPVanish, Kaspersky Secure Connection and VPN Unlimited, giving them a month to reply.

“In the cases of non-compliance with the obligations stipulated by the law, Roskomnadzor may decide to restrict access to a VPN service,” the watchdog said in a statement.

Reporting by Anton Zverev. Writing by Andrey Kuzmin; Editing by Alexander Smith